6 Weighted Indicators

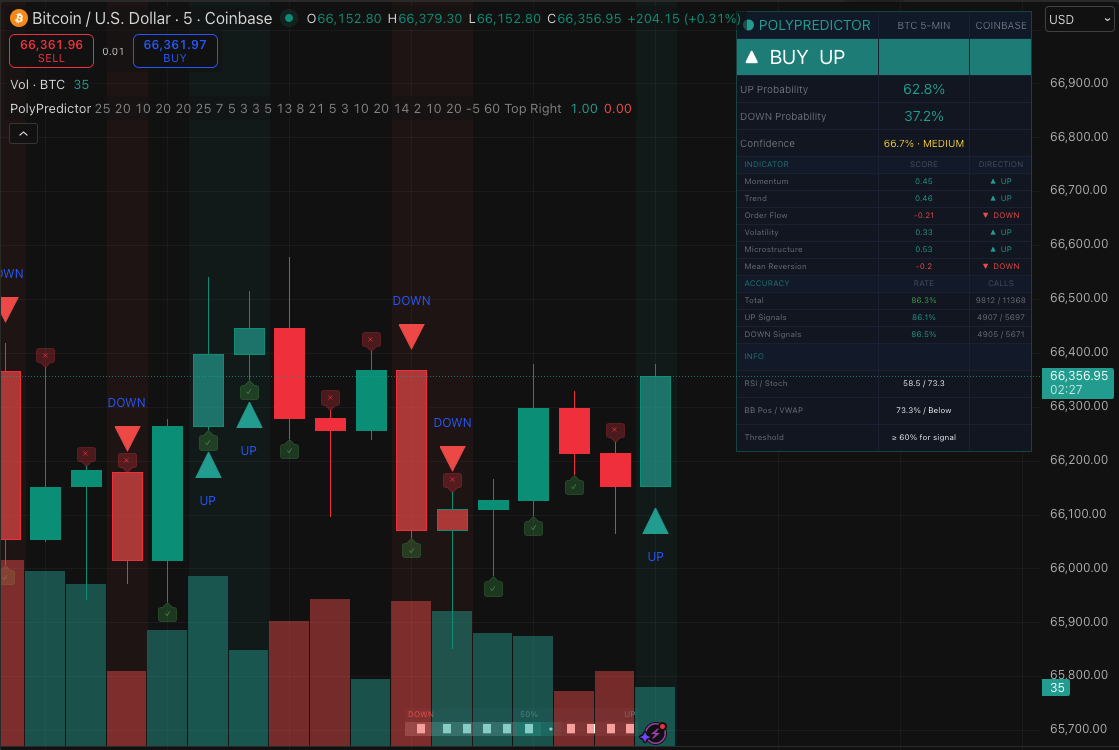

Momentum (RSI + MACD), Trend (EMA Slope), Order Flow (CVD + VWAP), Volatility (BB%B), Microstructure (Candle Analysis), and Mean Reversion (Z-Score). Each scored -1 to +1, weighted, and combined.

Regime-adaptive scoring engine with 6 weighted indicators, auto-switching between momentum and mean-reversion. Real-time probability, confidence levels, and built-in accuracy tracking.

Past performance does not guarantee future results. Not financial advice.

Every component is tuned for Polymarket's 5-minute Up/Down resolution windows across supported markets.

Momentum (RSI + MACD), Trend (EMA Slope), Order Flow (CVD + VWAP), Volatility (BB%B), Microstructure (Candle Analysis), and Mean Reversion (Z-Score). Each scored -1 to +1, weighted, and combined.

Auto-detects market regime via Bollinger Bandwidth. Boosts mean-reversion weights during squeezes, momentum weights during expansions. Research shows this is critical at 5-minute horizons.

Displays UP/DOWN probability as a percentage, updated every tick. Includes confidence scoring based on indicator agreement and signal strength. Visual probability meter at bottom.

Live tracks prediction accuracy right on the dashboard: total, UP calls, DOWN calls, and strong-signal-only accuracy. See checkmarks and crosses on each past bar.

Accounts for Polymarket's specific resolution rule: if the closing price equals the opening price, it resolves as "Up". This structural bullish bias is built into the scoring with a configurable offset.

All indicator parameters are pre-tuned based on quantitative research: RSI(7), Fast MACD(5,13,5), EMA(9/21), Stoch(5,3,3). Not guesswork — evidence-based settings for 5-min crypto.

A transparent scoring pipeline from raw market data to actionable signal.

OHLCV data from your TradingView chart. Use the 5-minute symbol that matches the active Polymarket market (for example BTC, ETH, or SOL) for the closest feed alignment.

Bollinger Bandwidth analysis determines if the market is in a Squeeze (range-bound, favor mean-reversion) or Expansion (trending, favor momentum). Weights adjust automatically.

Each indicator produces a score from -1 (strong bearish) to +1 (strong bullish). Momentum, Trend, Order Flow, Volatility, Microstructure, and Mean Reversion are weighted by regime.

Composite score converts to UP/DOWN probability (20-80% range). A small bullish bias (+0.5%) accounts for Polymarket's >= resolution rule. Confidence level computed from indicator agreement.

If probability exceeds your threshold: BUY UP or BUY DOWN signal appears. Strong signals (65%+) are highlighted differently. Optional TradingView alerts for each signal type.

Every parameter is exposed in TradingView's settings panel. Tune to your edge.

Momentum 25%Trend 20%Order Flow 15%Volatility 10%Microstructure 10%Mean Reversion 20%RSI Length 7MACD 5 / 13 / 5Fast / Slow EMA 9 / 21Stochastic K/D 5 / 3 / 3BB Length / StdDev 20 / 2.0Z-Score Activation 1.0Auto Regime OnSqueeze Threshold 0.8x avgMR Boost (Squeeze) 1.5xMom Boost (Expand) 1.5xSignal Threshold 55%Strong Signal 65%Bullish Bias (>=) +0.5%Dashboard, Meter, Signals ToggleableClear, unambiguous signals tell you exactly what to buy on Polymarket.

Probability: 65%+

High-confidence signal. Most indicators agree on bullish direction with strong individual scores. These setups typically deliver the best win rates.

Action: Buy "Up" on Polymarket

Probability: 55-65%

Moderate bullish lean. Some indicators agree, but not as strongly. Use with caution or smaller position sizes.

Action: Consider "Up" with smaller size

Probability: 45-55%

Mixed signals. Indicators disagree or are too weak. No edge detected for this 5-minute window.

Action: Skip this round

Probability: 65%+

High-confidence bearish signal. Strong indicator consensus pointing down. Best win rate among all signal types.

Action: Buy "Down" on Polymarket

Set your chart to the matching underlying symbol on 5-minute timeframe. Example: use BTC, ETH, or SOL symbols that match the market you trade.

Open Pine Editor, paste the script, click "Add to Chart". The dashboard and signals appear immediately.

Open your selected Polymarket 5-minute market alongside. When the indicator shows a strong signal, place your trade before the window closes.

One-time purchase. No subscription.

Full indicator with all features

Both options currently run through Telegram while payment and trial automation are being finalized. The TradingView button opens the public script preview.

Use a 5-minute TradingView chart and match the symbol to your Polymarket market. For BTC markets use a BTC/USD feed, for ETH markets use ETH/USD, and so on. The closer your chart feed is to the market's underlying reference, the better the alignment.

Polymarket resolves "Up" if the closing price is greater than or equal to the opening price. This means flat candles count as "Up" wins, creating a small structural bullish bias (~50.5-51.5% of 5-min candles are historically green). The indicator accounts for this with a configurable bias offset (default +0.5%).

Academic research shows that at 5-minute horizons, mean-reversion dominates during low-volatility periods (squeezes) while momentum works better during high-volatility expansions. The indicator detects the current regime via Bollinger Bandwidth and automatically adjusts indicator weights accordingly.

The indicator tracks every signal it generates against the actual outcome of each 5-minute candle (close >= open = Up). The dashboard updates this live across all visible bars. In the current screenshot sample: total accuracy is 86.3% and UP signals are 86.1%.

No. PolyPredictor is built for Polymarket 5-minute Up/Down markets in general. You can use it across supported crypto markets by switching to the matching TradingView symbol for each market.

The indicator works on any TradingView plan, including the free tier. However, a paid plan gives you real-time data (no 15-minute delay) and the ability to set alerts, both of which are important for 5-minute trading.

No. This is a technical analysis tool that provides probability estimates. It does not constitute financial, investment, or trading advice. Prediction markets carry risk and you can lose money. Past backtested performance does not guarantee future results. Always do your own research.

Questions about PolyPredictor? Reach out directly on Telegram.

Fastest response via Telegram. We typically reply within a few hours.